Buying generic medications should be simple-cheaper versions of brand-name drugs, same active ingredients, same effectiveness. But if you’ve ever checked the price at your local pharmacy only to find it jumped from $4 to $18 between visits, you know it’s anything but simple. The truth is, generic drug prices vary wildly-even within the same city-because of a tangled web of rebates, pharmacy benefit managers, and hidden discounts. You’re not imagining it. You’re just not seeing the full picture.

Why Generic Drug Prices Change So Much

Generic drugs aren’t like apples or toilet paper. You can’t just walk into any store and expect the same price. The cost you see at the counter is rarely the real cost. What you’re looking at is the list price-the starting point. The actual price you pay depends on your insurance, the pharmacy’s contract with your pharmacy benefit manager (PBM), and whether the pharmacy is even allowed to sell it at that price. For example, a 30-day supply of metformin might show up as $4 at CVS, $12 at Walgreens, and $1.50 at a small independent pharmacy. Why? Because that $4 price at CVS might be a promotional rate tied to your insurance plan’s formulary. The $12 price? That’s the pharmacy’s standard rate without your plan’s discount. And the $1.50? That pharmacy might be part of a bulk purchasing group or has a direct deal with a manufacturer. The system is designed so that only insiders-insurers, PBMs, and big pharmacy chains-know the real net price. Patients? They’re left guessing. That’s where price transparency tools come in.Real-Time Benefit Tools: What Doctors Use

If you’ve ever had your doctor switch your prescription after checking a screen during your visit, you’ve seen a Real-Time Benefit Tool (RTBT) in action. These are systems built into electronic health records like Epic and Cerner. They pull live data from your insurance plan and show the doctor exactly what you’ll pay out-of-pocket for each available medication. In 2025, about 42% of U.S. physician practices use RTBTs. Tools like CoverMyMeds and Surescripts connect directly to your insurer’s system. When your doctor types in a prescription, the tool instantly shows:- Out-of-pocket cost for the brand-name drug

- Cost for the generic alternative

- Whether a prior authorization is needed

- If you qualify for a manufacturer’s patient assistance program

GoodRx and Other Consumer Apps: What You Can Use Today

You don’t need a doctor’s office to find the best price. Apps like GoodRx, SingleCare, and RxSaver let you compare prices across hundreds of pharmacies nationwide. These tools are free, easy to use, and work whether you have insurance or not. Here’s how they work: They collect wholesale acquisition costs (WAC)-the price pharmacies pay to distributors-and then show you the lowest cash price available nearby. Some even offer printable coupons that can be used at the pharmacy counter. In 2024, 43% of U.S. pharmacies accepted GoodRx coupons. That’s more than 60,000 locations. And the savings? For common generics like lisinopril or atorvastatin, you can often save 50% to 80% compared to the uninsured list price. But don’t trust the app blindly. A 2025 Trustpilot review summed up the frustration: “The app shows $4, but when I get there, they say $15.” That happens because the app shows the best-case cash price, but your insurance might have a different contract with that pharmacy. Or the coupon might not be valid for your specific dose or quantity. Pro tip: Always call ahead. Ask: “If I pay cash with this coupon, what’s the final price?” Don’t assume the app’s number is guaranteed.

State Laws Are Changing the Game

Federal efforts to force transparency have stalled. The Medicare Two Dollar Drug List Model was canceled in March 2025. But states? They’re stepping in. As of April 2025, 23 states have passed laws requiring drug manufacturers to report price hikes. Twelve have created Prescription Drug Affordability Boards (PDABs) that can review and even cap prices for certain drugs. Minnesota’s law is one of the strongest. It requires manufacturers to report any price increase over 16% over two years. And it gives patients access to a public portal where they can compare prices between nearby pharmacies. One patient there saved $287 a year just by switching to a cheaper pharmacy for their generic thyroid medication. California requires manufacturers to notify the state before raising prices on high-cost generics. New York mandates that pharmacies post their cash prices online. These laws don’t fix everything-but they give you more power to ask the right questions.What You Can Do Right Now

You don’t have to wait for the system to change. Here’s your action plan:- Use GoodRx or SingleCare to compare cash prices for your generic meds. Enter your drug name, dose, and quantity.

- Call at least three local pharmacies. Ask: “What’s the cash price for this with a coupon?” Don’t say “insurance.”

- Check if your drug is on your insurer’s formulary. Log into your plan’s website and search for the drug name.

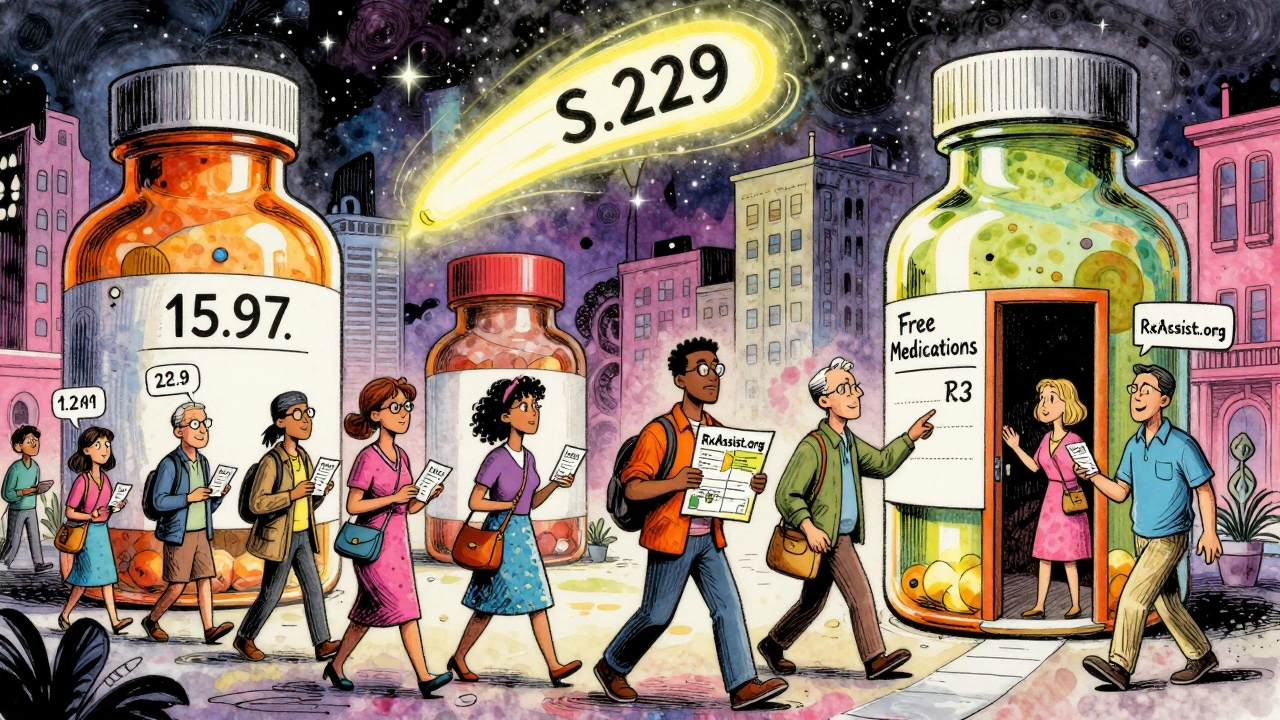

- If the price is still too high, visit RxAssist.org. It’s a free directory of manufacturer assistance programs. You might qualify for free or discounted meds.

- If you’re on Medicare, ask your pharmacist about the Low-Income Subsidy (LIS) program. It caps your monthly drug costs at under $10.

The Big Problem: Net Prices Are Still Hidden

No tool-no matter how advanced-can show you the true net price. That’s because rebates between drugmakers and PBMs are secret. A drug might have a $100 list price, but the PBM gets a $70 rebate. The pharmacy still gets paid $100, but the net cost to the system is $30. You never see that $30. You’re stuck with the $100. Experts agree: Without revealing net prices, transparency is incomplete. That’s why some doctors argue these tools help patients, but don’t fix the real problem. The system still rewards high list prices because rebates are tied to them. Still, even partial transparency helps. Seeing that a generic costs $1.50 instead of $15 gives you leverage. You can ask your doctor: “Is there a cheaper option?” You can ask your pharmacist: “Why is this so much more here?” You can walk away and go elsewhere.What’s Coming Next

In January 2025, the U.S. Senate introduced the Drug-price Transparency for Consumers Act (S.229). If passed, it would require drug companies to include the wholesale price in TV and online ads. Imagine seeing a commercial for insulin that says: “This 30-day supply costs $125 wholesale.” That could change how people think about drug pricing. CMS also plans to release new technical guidance for the Prescription Drug File by the end of 2025. That could force insurers to report total drug spending, including rebates. It’s not full transparency-but it’s a step. For now, the best tool you have is your own awareness. Don’t accept the first price. Don’t assume your insurance always gets you the best deal. And don’t be afraid to ask.Why is my generic drug so expensive even though it’s not brand-name?

Generic drugs are cheaper than brand names, but their prices still vary because of how the system works. Pharmacies pay different amounts based on contracts with pharmacy benefit managers (PBMs). Your insurance plan may have negotiated a lower price with one pharmacy but not another. Some pharmacies offer cash discounts, while others charge the full list price. Even the same generic from the same manufacturer can cost more at one location than another due to these hidden deals.

Can I use GoodRx even if I have insurance?

Yes. GoodRx shows cash prices, which are sometimes lower than your insurance copay-especially for generics. If the GoodRx price is cheaper, you can choose to pay cash instead of using insurance. Just tell the pharmacist you want to use the GoodRx coupon instead of your insurance. Note: You can’t combine insurance and coupons, but you can pick the lowest option.

Are there free programs to get generic drugs for little or no cost?

Yes. Programs like RxAssist.org and NeedyMeds.org list manufacturer assistance programs for low-income patients. Many drugmakers offer free or deeply discounted medications if you meet income guidelines. In 2024, 78% of people who applied through RxAssist got their meds at no cost. The catch? The application process can be confusing. Start with your doctor’s office-they often have staff who help patients apply.

Why does my pharmacy say the coupon doesn’t work when the app says it should?

Pharmacy systems aren’t always updated in real time. The coupon might be valid for a different dose, quantity, or pharmacy chain. Sometimes the coupon is only good for cash payments, and your insurance is already being processed. Always ask the pharmacist to manually enter the coupon code or call the number on the coupon. If they say it’s invalid, ask them to check again or try a different pharmacy.

Should I switch pharmacies to save money on generics?

Absolutely. Prices for the same generic drug can vary by $10 or more between pharmacies just a few blocks apart. Use GoodRx or call around before filling a prescription. Some independent pharmacies offer lower prices than big chains. Don’t assume your usual pharmacy is the cheapest. Even small savings add up over time-especially if you take multiple medications.

Stacy Tolbert 7.12.2025

I spent $87 last month just on my blood pressure med because I didn't check prices. I thought insurance was helping. It wasn't. I cried in the pharmacy parking lot. Then I found GoodRx. Now I pay $3. I'm not okay with how broken this is, but at least I'm not helpless anymore.

Raja Herbal 7.12.2025

So let me get this straight - you’re telling me the same pill, made in the same factory, costs 20x more just because some middleman got a secret kickback? And we’re supposed to be grateful for apps that show us the *least* terrible option? Welcome to capitalism, baby. I’m just here for the popcorn.

Iris Carmen 7.12.2025

goodrx saved my life literally. i used to skip doses cuz i couldnt afford it. now i just call the little pharmacy down the street. they dont even ask for id. just hand em the coupon and walk out. also, they give me free mints. small wins.

Rich Paul 7.12.2025

Y’all are missing the real issue. PBMs aren’t the villains - they’re symptom carriers. The real problem is the 3-tiered rebate system tied to WAC, which incentivizes list price inflation to maximize rebate capture. The FDA doesn’t regulate pricing, CMS won’t touch it, and state PDABs are toothless without federal backing. You think GoodRx fixes this? Nah. It’s just a bandaid on a hemorrhage. Real transparency means forcing manufacturers to disclose net prices to the public - not just cash prices. Until then, you’re just playing whack-a-mole with your wallet.

Katherine Rodgers 7.12.2025

Oh wow, a 37% drop in out-of-pocket costs? That’s so cute. Like saying ‘I saved $2 on a $2000 surgery.’ Meanwhile, the PBM pocketed $70 and the manufacturer raised the list price 400% to make up for it. Congrats, you got the discount on the lie. The real cost? Your dignity. And your trust. Both are gone.

Lauren Dare 7.12.2025

Let’s be real - RTBTs are a corporate PR stunt wrapped in EHR software. They only show what the insurer wants you to see. If your plan excludes a drug from formulary, the tool won’t suggest alternatives - it’ll just say ‘not covered.’ And the data? Often 2–3 days behind. I’ve seen doctors prescribe based on RTBT, only for the pharmacy to say ‘that’s not what we’re charging.’ It’s not transparency. It’s theater with a side of HIPAA.

Taya Rtichsheva 7.12.2025

just called 4 pharmacies for my metformin. one said 1.50. one said 15. one said they dont take goodrx. one said theyll match the lowest price if i tell them the name of the other place. i went with the one that said 1.50. they gave me a hug. i cried. again. this system is broken but i guess we just keep doing this weird dance

Mona Schmidt 7.12.2025

For anyone new to this: if you’re on Medicare Part D, you’re eligible for the Low-Income Subsidy (LIS) if your income is below 150% of the federal poverty level. Apply through Social Security - it’s free, and they’ll retroactively adjust your payments for up to 12 months. Also, RxAssist.org has a filter for ‘no application fee’ programs. Don’t let bureaucracy scare you off. Your health is worth the paperwork. And if you need help filling out forms, your local library has free tech volunteers. Seriously. Go ask them.

Guylaine Lapointe 7.12.2025

So you’re telling me people are still using GoodRx like it’s some kind of moral victory? Meanwhile, the same companies that profit from inflated list prices own the apps. GoodRx is owned by a private equity firm that bought a pharmacy chain. SingleCare? Backed by a PBM. You’re not fighting the system - you’re paying for the privilege of being shown the least painful way to bleed out. Stop being grateful for crumbs. Demand the whole damn table.