When you walk into a pharmacy to pick up your monthly prescription, you might assume the price is fixed - set by the manufacturer, negotiated by your insurance, and beyond your control. But here’s the truth: generic drug prices don’t stay the same. They crash - sometimes overnight - when more companies start making the same medicine. This isn’t magic. It’s a price war. And if you know how to play it, you can save hundreds, even thousands, of dollars a year.

How Generic Drug Price Wars Actually Work

When a brand-name drug’s patent expires, other companies can legally make identical versions. These are called generics. They don’t need to repeat expensive clinical trials. All they need is proof they work the same way. Once one generic hits the market, it’s usually 30% cheaper than the brand. But when a second, third, or fourth company joins? Prices drop fast. Data from the FDA shows clear patterns. With just two generic makers, prices fall about 54% compared to the brand. With four, they drop nearly 80%. And when six or more companies are selling the same drug? Prices plunge over 95%. That’s not a rumor. That’s what happened with metformin, lisinopril, and atorvastatin - common drugs for diabetes, high blood pressure, and cholesterol. In markets with heavy competition, these drugs can cost less than $5 for a 30-day supply. But here’s the catch: you won’t always see those savings at the register.Why You’re Still Paying Too Much (Even When Prices Are Low)

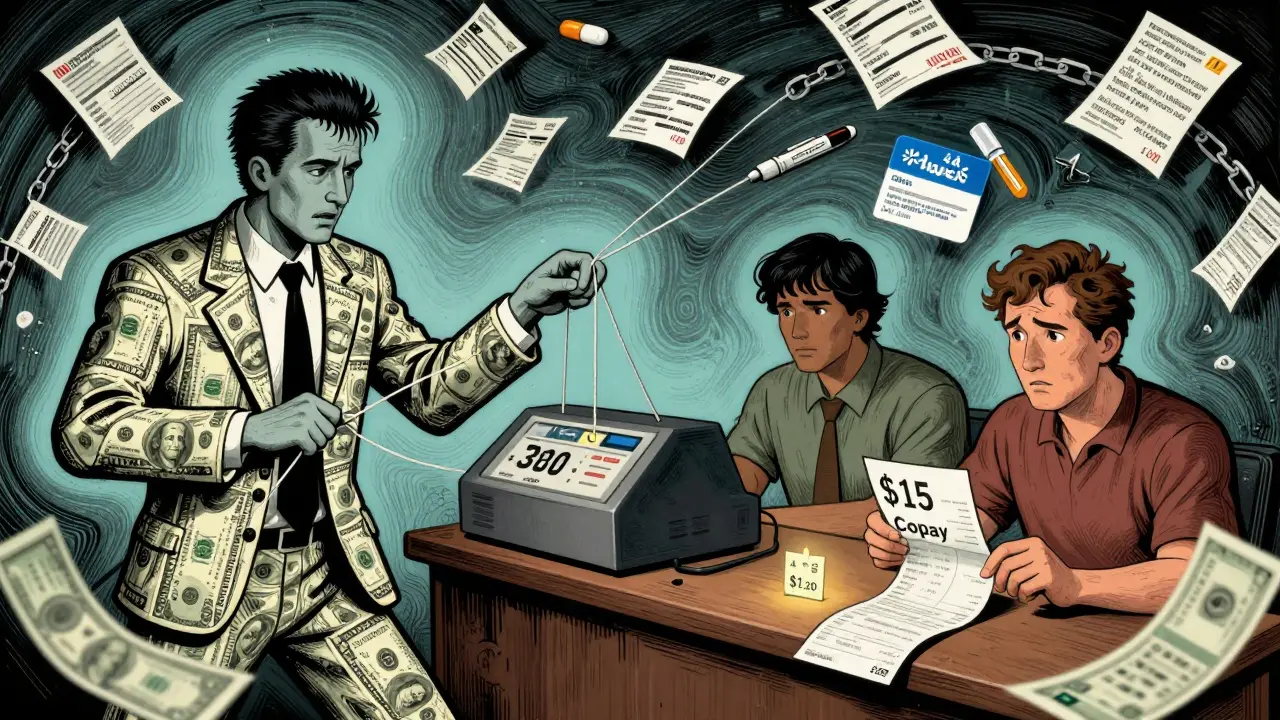

The system isn’t broken. It’s just layered. Behind the scenes, pharmacy benefit managers (PBMs) - middlemen hired by insurance companies - control which drugs get covered and at what price. They negotiate discounts with drugmakers, but they don’t always pass those savings to you. One sneaky trick? Spread pricing. A PBM might tell your insurer they paid $2 for a pill, but they actually paid $0.50. You’re charged the $2, and the PBM pockets the difference. Even if the cash price is $1, your copay could still be $15 because your insurance plan doesn’t reflect the real cost. Another issue: formularies. Insurance plans often push you toward slightly more expensive generics because the PBM gets a bigger kickback. Or worse - they don’t let pharmacists tell you the cash price is lower than your copay. That’s called a gag clause. It was banned in 2018, but many people still don’t know to ask. A 2022 study from the USC Schaeffer Center found that in nearly 3 out of 10 cases, the cash price for a generic was lower than the insurance copay. Yet most people never check.Real Examples: Who’s Saving and Who’s Getting Screwed

Some people pay $0 for their generics. Walmart’s $4 program covers over 100 common medications. CVS, Target, and Amazon Pharmacy offer similar deals. On Reddit, users report paying nothing for metformin, levothyroxine, or sertraline - drugs that cost $100+ a month just a decade ago. But then there’s the flip side. People pay $300 for an EpiPen, even though generic epinephrine auto-injectors exist. Why? Because only two companies make them. No competition. No price war. And because PBMs favor branded versions in their formularies, insurers don’t push the cheaper option. Insulin is another horror story. Even though biosimilar insulins are now available, prices haven’t dropped like they did with other generics. Why? Because a handful of companies control nearly the entire market. That’s not competition - that’s collusion. Consumer Reports found that 42% of people didn’t know they could pay cash for generics and save money. And 1 in 5 were paying more than the cash price because their insurance didn’t cover the lowest-cost generic - even when it was medically identical.

How to Actually Save Money (Step by Step)

You don’t need a degree in pharmacy to beat the system. Here’s what works:- Ask for the cash price - every time. Don’t assume your insurance is giving you the best deal. Pharmacies are required to tell you the cash price, even if you have insurance.

- Compare prices across pharmacies - GoodRx and SingleCare show real-time prices. For the same 30-day supply of generic atorvastatin, one pharmacy might charge $4, another $38. That’s not a typo.

- Use discount apps - GoodRx, SingleCare, and Blink Health often beat insurance. Some even let you print a coupon or scan a barcode at the counter.

- Check the AB rating - The FDA gives generics an AB code if they’re bioequivalent. If it says AB, it’s safe to switch. If it says BN or other codes, ask your pharmacist why.

- Focus on chronic meds - A $5 difference on a daily pill adds up to $1,825 a year. That’s more than most people spend on gym memberships or streaming services.

The Bigger Picture: Why This Matters Beyond Your Wallet

The U.S. spends over $71 billion a year on generic drugs. They make up 90% of prescriptions but only 23% of total drug spending. That’s the power of competition. But the market is changing. Five companies - Teva, Viatris, Sandoz, Amneal, and Aurobindo - control over 60% of the generic market. That’s not competition. That’s an oligopoly. And when prices fall too low, companies quit. That’s why we see drug shortages - even for simple antibiotics and blood pressure pills. When no one can make a profit at $0.10 a pill, they stop making it. The government is starting to act. The 2022 Inflation Reduction Act lets Medicare negotiate prices for some drugs. The 2023 Pharmacy Benefit Manager Transparency Act aims to ban spread pricing. The FDA is fast-tracking approvals for generics in short-supply markets. But none of that matters if you don’t know how to use the tools you already have.

What’s Next? The Future of Generic Pricing

More generics are being approved than ever. In 2023, the FDA approved over 1,000 new generic drugs - up from 748 the year before. That means more price wars coming in 2025 and beyond. The key will be transparency. If PBMs are forced to show exactly how much they pay and how much they charge, consumers will finally see the real savings. If insurers stop pushing expensive generics for kickbacks, prices will drop even further. For now, the power is in your hands. You don’t need to wait for Congress or your insurance company to fix this. You can walk into any pharmacy, ask for the cash price, and walk out paying less than half.Frequently Asked Questions

Are generic drugs really the same as brand-name drugs?

Yes. The FDA requires generics to have the same active ingredients, strength, dosage form, and route of administration as the brand-name version. They must also prove they work the same way in the body. The only differences are in inactive ingredients like fillers or dyes - which rarely affect how the drug works.

Why is my generic drug suddenly more expensive?

It’s likely because a manufacturer left the market. When prices drop too low, some companies can’t make a profit and stop producing the drug. Fewer competitors mean less pressure to lower prices. This is common with older, low-cost generics like doxycycline or furosemide. Check GoodRx or ask your pharmacist for alternatives.

Can I use GoodRx with my insurance?

You can’t stack them, but you can choose. Always compare the GoodRx price to your insurance copay. In many cases, the GoodRx coupon will be cheaper - especially for chronic medications. Pharmacies are required to accept GoodRx even if you have insurance.

Why do pharmacies charge different prices for the same generic?

Each pharmacy negotiates its own price with distributors and PBMs. Big chains like CVS or Walgreens often have higher prices because they include overhead costs and PBM agreements. Independent pharmacies and warehouse stores like Costco or Walmart often have lower prices because they buy in bulk and avoid PBM middlemen.

Should I always choose the cheapest generic?

Almost always. If the generic has an AB rating from the FDA, it’s approved as equivalent. The only exception is if you have a known allergy to an inactive ingredient - which is rare. If your doctor insists on a specific brand, ask why. Most of the time, it’s habit, not medical necessity.

Mussin Machhour 24.12.2025

Just saved $80 this month on my atorvastatin by using GoodRx. Walked in thinking I’d pay $40, turned out it was $3. Pharmacist didn’t even mention it unless I asked. Why do people just accept what the machine says? You got to be the detective.

Michael Dillon 24.12.2025

Let me be the first to say this: the whole generic drug system is a scam wrapped in a spreadsheet. You think you’re saving money? Nah. You’re just paying the PBM’s hidden fee under a different name. The FDA’s AB rating? That’s a placebo for the gullible. If you’re not reading the full ANDA filings, you’re being played.

And don’t get me started on Walmart’s $4 list. It’s a loss leader. They lure you in with metformin, then upsell you on supplements and candy bars. You think you’re winning? You’re just the bait.

Gary Hartung 24.12.2025

Oh, the irony… The very system designed to make healthcare affordable… is now a labyrinth of corporate greed, regulatory capture, and PBM-enabled financial predation… And yet… we… are… expected… to… navigate… it… with… a… coupon… from… a… website… that… doesn’t… even… disclose… its… profit… margin…?

It’s not a price war… it’s a masquerade… with a pharmacy receipt as the mask.

Ben Harris 24.12.2025

Why are we even talking about this like it's new? I've been paying cash for my levothyroxine since 2019 and no one ever told me to ask. My pharmacist thought I was weird. Now I tell everyone. Seriously. Just ask. It's not rocket science. The system is broken but your wallet doesn't have to be

Oluwatosin Ayodele 24.12.2025

Back home in Nigeria, we buy generics in bulk from India for less than $1 per month. No GoodRx needed. No insurance. No pharmacy benefit managers. Just direct import, local distributors, and trust in the FDA’s bioequivalence standards. The U.S. system is not broken-it was designed this way to enrich shareholders, not patients.

Stop asking for coupons. Demand systemic change. Or move.

Terry Free 24.12.2025

Wow. Someone actually did research. Who knew generics weren’t just ‘cheap knockoffs’? I thought they were like Walmart-brand toilet paper-same function, but you feel guilty using it. Turns out they’re literally the same pills. I’m just mad I didn’t know this before I paid $120 for lisinopril last year.

Winni Victor 24.12.2025

My insurance made me pay $55 for sertraline while the cash price was $7. I cried in the parking lot. Not because I’m dramatic-because I’m tired. I work two jobs and still can’t afford to be healthy. And now I’m supposed to be a pharmacy sleuth? What kind of dystopia are we living in where your mental health meds require a PhD in PBM linguistics?

Jason Jasper 24.12.2025

I used to think the system was just inefficient. Now I see it’s actively hostile. But I also think people are starting to wake up. The fact that we’re even talking about this-on Reddit, in waiting rooms, at dinner tables-that’s the first real change. You don’t need to fix everything. Just ask for the cash price once. That’s enough to start.

Lindsay Hensel 24.12.2025

Thank you for this comprehensive, compassionate, and urgently necessary exposition. The human cost of pharmaceutical opacity is immeasurable-and yet, we persist in silence. May this knowledge ripple outward, one cash price inquiry at a time.